Credit default swaps surge and its impact on finance

Anúncios

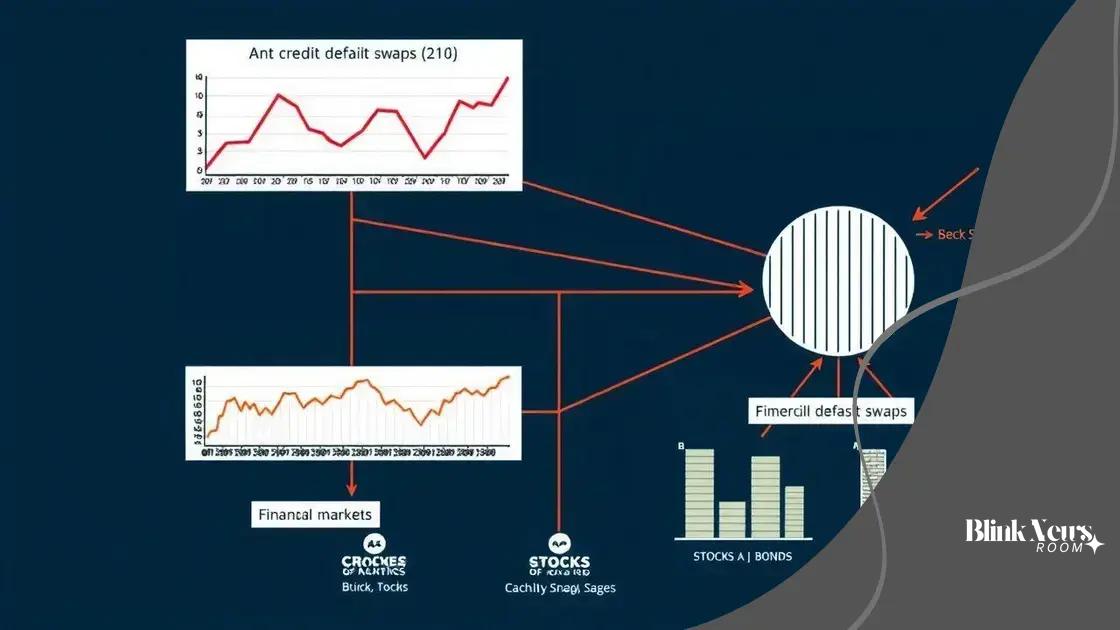

Credit default swaps (CDS) are financial instruments that allow investors to hedge against credit risk by transferring potential losses from defaults to another party, enhancing risk management in financial markets.

Credit default swaps surge is capturing the attention of investors and financial experts alike. Have you wondered how this trend impacts your investments and the broader economy? Let’s dive into the details.

Anúncios

Understanding credit default swaps

Understanding credit default swaps is essential for anyone interested in the financial markets. These financial instruments have been gaining traction, significantly impacting investment strategies and risk management.

What are Credit Default Swaps?

Credit default swaps (CDS) are essentially contracts that allow an investor to “swap” their credit risk with another party. They act as insurance policies against default on debt obligations, providing financial security against potential losses.

These swaps can also serve as a way to speculate on the creditworthiness of a buyer or borrower. Investors who believe a borrower will default may buy a CDS to profit from such an event.

Anúncios

Key Components of Credit Default Swaps

There are a few crucial components involved in credit default swaps. Understanding these can help you grasp their functionality better:

- Reference Entity: The borrower whose credit risk is being insured.

- Protection Buyer: The party purchasing the CDS, seeking insurance against default.

- Protection Seller: The entity that assumes the risk in exchange for a premium.

- Credit Events: Specific circumstances that trigger a payment under the swap, such as bankruptcy or reduced credit rating.

The use of credit default swaps has surged as financial markets evolve. They offer flexibility and can be tailored to suit various risk appetites. As a result, more investors are leaning toward utilizing these instruments to manage their portfolios effectively.

However, the complexity of CDS also introduces potential risks. Market participants must be diligent in analyzing these instruments before incorporating them into their strategies. The interplay between supply and demand affects their pricing, making it vital for investors to stay informed about market conditions.

The Impact of Credit Default Swaps on the Market

The growing popularity of credit default swaps has had significant implications for the overall financial landscape. These instruments can elevate risk levels for certain investors, as they significantly influence the borrowing cost of entities involved.

Despite their benefits, a lack of transparency in the CDS market can also lead to net negativity. Regulatory perceptions have shifted, urging more oversight to prevent market manipulation and ensure financial stability.

The recent surge in credit default swaps

The recent surge in credit default swaps (CDS) has raised eyebrows across the financial landscape. As economic conditions shift and uncertainties loom, many investors turn to these instruments to hedge against potential risks.

Reasons for the Surge

The increasing use of credit default swaps can be attributed to multiple factors. Investors now see them as essential tools for managing credit risk effectively. They allow for flexibility and can provide significant protection against defaults.

- Market Volatility: As markets become more uncertain, investors seek ways to mitigate risks.

- Rising Debt Levels: With corporations and governments taking on more debt, the demand for CDS to safeguard against defaults increases.

- Speculative Opportunities: Some traders use CDS to speculate on credit tightening or improvements.

Moreover, the accessibility of these products has improved. More financial institutions are offering CDS contracts, making them easier to buy and sell. However, while these benefits are attractive, they also come with risks that need careful consideration.

Implications for Investors

This recent growth in credit default swaps affects the investment landscape significantly. Investors must stay informed about the underlying factors driving CDS trends. Being aware of the creditworthiness of reference entities is crucial to make informed decisions.

Some investors may explore CDS as a means to protect their portfolios against market downturns. However, they must also recognize that misuse of these instruments can lead to substantial losses. Proper research and risk assessment are necessary before incorporating them into any investment strategy.

Furthermore, regulatory bodies are closely monitoring the CDS market due to its rapid expansion. New guidelines and regulations may emerge to ensure that these products remain transparent and under control, mitigating the systemic risks they pose.

Implications for financial markets

The implications for financial markets stemming from the recent surge in credit default swaps are significant and multifaceted. As these instruments gain popularity, they influence various aspects of the financial landscape.

Impact on Credit Markets

The rise of credit default swaps affects the credit market directly. More investors are using CDS to hedge against potential defaults, increasing the demand for these products. This demand can lead to tighter spreads on corporate bonds as businesses seek to reassure investors of their creditworthiness.

- Increased Liquidity: CDS can enhance liquidity in the credit markets by allowing investors to manage risk more actively.

- Pricing Transparency: With more market participants engaging in CDS transactions, pricing becomes more transparent, reflecting true risk levels.

- Risk Assessment: Investors using CDS can better assess the credit risk of companies, supporting more informed investment decisions.

However, while there are advantages, the growing use of CDS can also introduce systemic risks. Increased consensus in hedging can lead to similar behaviors among investors, amplifying market volatility.

Market Sentiment and Speculation

Furthermore, the implications of credit default swaps extend to market sentiment. Traders often use CDS as signals for potential changes in a company’s financial health. High CDS spreads may indicate growing concerns about a company’s ability to repay debt.

As investor sentiment fluctuates, it can create a feedback loop where market participants react to perceived risks in ways that can exacerbate existing issues. Speculative trading in CDS can drive volatility in underlying assets, affecting both corporations and investors alike.

Despite their potential pitfalls, credit default swaps are here to stay. Understanding their implications remains critical for anyone involved in trading or investing in financial markets.

Risk management and credit default swaps

Risk management is a crucial aspect for investors and corporations, particularly in today’s climate of uncertainty. The use of credit default swaps (CDS) plays an important role in this domain. These financial instruments allow parties to transfer and manage credit risk associated with underlying assets.

Understanding Risk Management with CDS

Integral to effective risk management, credit default swaps provide a way for investors to hedge against potential defaults. When an investor buys a CDS, they essentially purchase insurance against a borrower defaulting on their obligations. This strategy mitigates the risk of loss, allowing investors to protect their portfolios.

- Diversification: CDS can diversify a portfolio by allowing investors to take positions across different entities without needing to own the underlying assets.

- Reduction of Overall Risk: By using CDS, investors can minimize their exposure to credit risk, especially during times of financial turmoil.

- Facilitating Market Transactions: CDS can help facilitate transactions between buyers and sellers, enhancing market liquidity.

Investors need to approach credit default swaps with a clear understanding of potential risks involved as well. For instance, while they provide a hedge, they can also introduce counterparty risk. This risk arises if the seller of the CDS fails to make payments when a credit event occurs.

Integrating CDS into Risk Management Strategies

Incorporating credit default swaps into broader risk management strategies requires careful planning. Investors must assess the quality of the underlying assets and the credibility of the protection seller. A thorough analysis of market conditions and potential credit events is vital for effective decision-making.

Moreover, using CDS in conjunction with other financial instruments can enhance the overall risk management framework. This approach allows for more nuanced strategies that can adjust to changing market dynamics. As the market evolves, so too should the strategies employed by investors to manage risk effectively.

Overall, credit default swaps serve as powerful tools in the arsenal of risk management, providing both opportunities and challenges that investors must navigate.

Future outlook for credit default swaps

The future outlook for credit default swaps (CDS) continues to generate interest among investors and financial analysts. As the market evolves, these instruments are likely to play an increasingly significant role in managing credit risk.

Trends Impacting Credit Default Swaps

Several key trends are shaping the future of credit default swaps. Increased regulatory scrutiny and changes in market dynamics may influence how these products are used. Investors are becoming more aware of the risks involved and are looking for ways to navigate them effectively.

- Technological Advancements: The integration of technology in trading and risk assessment processes is making CDS transactions faster and more efficient.

- Regulatory Changes: Enhanced regulations may lead to greater transparency in the CDS market, which could build investor confidence.

- Market Globalization: As more international investors participate, the demand for diverse CDS products may rise, offering new opportunities for hedging.

Moreover, the demand for credit risk mitigation tools is likely to increase, particularly in uncertain economic climates. Investors will look to CDS as a viable option to hedge their investments against potential defaults in a variety of sectors. As more entities issue debt, the relevance of credit default swaps in investment portfolios is expected to grow.

Challenges Ahead

Despite the positive outlook, challenges remain for the credit default swaps market. One major concern is counterparty risk, which can be exacerbated by increased market volatility. Investors must remain vigilant and ensure that they only engage with credible and secure parties when trading CDS.

Additionally, as the market for credit default swaps expands, the potential for misuse may increase. It is important for regulators to continue monitoring the market to prevent excessive risk-taking that could jeopardize overall financial stability.

Overall, while the future for credit default swaps looks promising, stakeholders must work together to address the challenges and ensure that these instruments continue to be effective tools for managing risk.

In summary, the landscape of credit default swaps (CDS) is evolving rapidly. With their increasing use in risk management, these instruments provide investors with vital tools to protect their assets. As trends such as technological advancements and regulatory changes shape the market, stakeholders need to remain vigilant. While opportunities abound, awareness of risks associated with CDS is essential. By understanding and adapting to these dynamics, investors can leverage credit default swaps to navigate the complexities of modern finance effectively.

FAQ – Frequently Asked Questions about Credit Default Swaps

What is a credit default swap?

A credit default swap (CDS) is a financial contract that allows an investor to ‘swap’ credit risk with another party, usually as insurance against default.

How do credit default swaps work?

In a CDS, the protection buyer pays a premium to the protection seller, who compensates the buyer if a credit event occurs, such as default.

What are the benefits of using credit default swaps?

CDS provide investors with a way to hedge against credit risk, diversify their portfolios, and manage exposure to potential defaults.

What risks are associated with credit default swaps?

Key risks include counterparty risk, market volatility, and the potential for misuse, which can lead to significant financial losses.